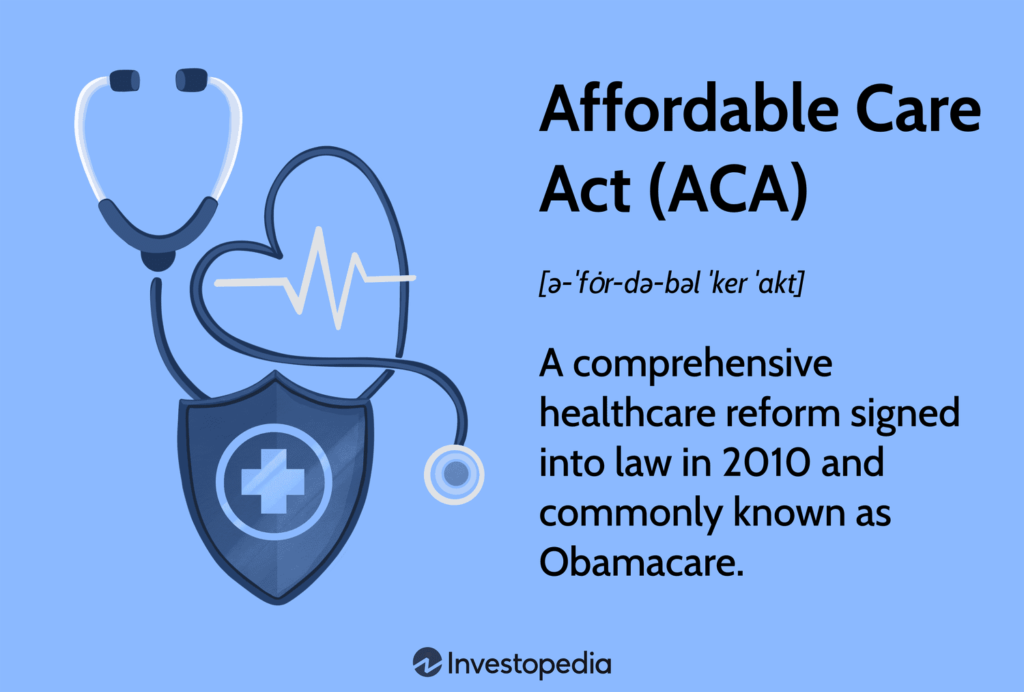

Health insurance in the United States has evolved significantly over the decades, shaping how Americans access medical care and manage healthcare costs. Historically, the system has been characterized by employer-sponsored plans, government programs like Medicare and Medicaid, and more recently, the Affordable Care Act (ACA). This evolution has been shaped by various political, economic, and social factors, and each stage has had profound implications on healthcare accessibility and affordability.

In this article, we will take a closer look at the history of health insurance in the U.S., examining how it transitioned from employer-sponsored plans to the ACA, and the impact this shift has had on the American healthcare system.

The Beginnings of Health Insurance in the U.S.

1. The Early Days of Healthcare in the U.S.

Before the 20th century, healthcare in the United States was largely unregulated, and medical expenses were paid out-of-pocket. Individuals were expected to cover their own medical costs, and few options for insurance existed. In the early 1900s, however, some companies began offering limited health insurance to employees, but it was far from the system we know today.

2. The Rise of Employer-Sponsored Health Insurance (Pre-WWII Era)

In the early 20th century, health insurance was a relatively niche offering, and only a small percentage of workers had access to it. This began to change dramatically during and after World War II. With wage controls in place during the war, employers sought new ways to attract workers and offer additional benefits. Health insurance quickly became a popular incentive.

- Wartime Wage Controls: During World War II, the government implemented wage controls to prevent inflation. However, employers needed a way to compete for workers in a tight labor market. Offering health insurance became a valuable tool to attract and retain employees.

- The Establishment of Group Health Plans: Employers began offering group health insurance as a fringe benefit to employees. This marked the beginning of employer-sponsored health insurance as a standard part of compensation. The government encouraged this growth by making employer-provided health insurance premiums tax-deductible.

The Growth of Employer-Sponsored Health Insurance

3. The Post-War Boom and Expanding Coverage

After World War II, employer-sponsored health insurance became more widespread, and by the 1950s and 1960s, it was available to millions of workers across the United States. This period marked a significant increase in private health coverage, with many employers offering plans that covered hospital stays, doctor visits, and surgeries.

- Employer-Based Coverage: By the 1960s, employer-based health insurance was the dominant form of coverage for working Americans, and it became a defining feature of the U.S. healthcare system.

- The Shift Toward Managed Care: In the late 20th century, insurance companies began developing managed care plans, which focused on controlling costs and improving efficiency through networks of providers, referrals, and preventive care.

4. The Challenges of Employer-Sponsored Insurance

While employer-sponsored health insurance grew rapidly, it was not without its challenges. As health insurance costs began to rise, employers struggled to maintain affordable plans for employees. The cost of health benefits for businesses began to outpace inflation, and workers faced higher premiums, deductibles, and co-pays.

- Rising Healthcare Costs: In the 1980s and 1990s, healthcare costs soared, making it more difficult for small businesses to provide affordable health insurance. As a result, many workers found themselves with limited access to coverage or faced higher out-of-pocket expenses.

- Coverage Gaps: Employer-sponsored insurance also left gaps in coverage, particularly for those who were unemployed or self-employed. Many workers lost their health insurance when they left a job, and there was no universal coverage for all Americans.

The Advent of Medicare and Medicaid (1960s)

5. Government-Sponsored Healthcare Programs

In the 1960s, the U.S. government introduced two major programs to provide healthcare coverage for specific groups of the population: Medicare and Medicaid.

- Medicare: Introduced in 1965, Medicare provides health insurance for Americans aged 65 and older, regardless of income or medical history. It also covers certain younger individuals with disabilities. Medicare became a vital part of the U.S. healthcare system, particularly as the population of older adults grew.

- Medicaid: Medicaid, also established in 1965, provides health coverage for low-income individuals and families. Unlike Medicare, Medicaid is jointly funded by the federal government and states, with each state having its own eligibility requirements and program administration.

These programs helped to reduce the number of uninsured Americans and marked a significant step in the development of the U.S. healthcare system.

The Affordable Care Act (ACA): A Game-Changer

6. The Birth of the ACA (2010)

In 2010, President Barack Obama signed the Affordable Care Act (ACA) into law, fundamentally changing the U.S. healthcare landscape. The ACA was designed to address the shortcomings of the existing system, including the high number of uninsured individuals and the rising cost of health insurance.

- Health Insurance Marketplaces: The ACA established state-based health insurance exchanges (also known as marketplaces), where individuals and families could purchase health insurance plans. These exchanges provided a competitive environment with standardized options and subsidies based on income, helping to make coverage more affordable for millions of Americans.

- Medicaid Expansion: The ACA also expanded Medicaid eligibility in participating states, allowing more low-income individuals to access healthcare. This was one of the most significant components of the law, increasing coverage for millions of uninsured Americans.

7. Key Provisions of the ACA

The ACA introduced several key provisions that have had a lasting impact on the U.S. health insurance system:

- Mandate to Buy Insurance: One of the most controversial provisions of the ACA was the individual mandate, which required most Americans to have health insurance or pay a penalty. The goal was to increase the number of insured individuals and stabilize the insurance market. However, the individual mandate was effectively repealed in 2019.

- Pre-existing Conditions: The ACA prohibited insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. This provision provided critical protections for individuals with chronic illnesses and other health conditions.

- Essential Health Benefits: The ACA required all health plans to cover a set of essential health benefits, including preventive care, prescription drugs, mental health services, and maternity care, ensuring that basic healthcare needs were met for all enrollees.

- Preventive Services: The ACA expanded access to preventive services, such as vaccinations, screenings, and wellness visits, with no out-of-pocket costs to consumers. This shift toward preventive care has helped reduce long-term healthcare costs and improved public health.

8. The ACA’s Impact on Employer-Sponsored Insurance

The introduction of the ACA significantly impacted employer-sponsored health insurance. While many employers continued to offer coverage, some smaller businesses chose to provide their employees with insurance through the ACA’s marketplaces rather than managing their own employer-sponsored plans. The law also introduced requirements for larger employers to provide affordable coverage to their employees.

- Small Business Health Options Program (SHOP): The ACA created the SHOP program to help small businesses offer health insurance to employees. This gave smaller employers more affordable options for providing coverage.

- Employer Mandate: The ACA introduced the employer mandate, which required large businesses (with 50 or more employees) to offer health insurance to their employees or face penalties. This helped to expand coverage among the workforce.

Challenges and Criticisms of the ACA

9. Continued Coverage Gaps

While the ACA helped reduce the number of uninsured Americans, millions are still without health coverage. Some states opted out of Medicaid expansion, leaving low-income individuals without access to affordable insurance. Additionally, some individuals may still struggle to afford the premiums, deductibles, and co-pays required by ACA plans.

10. Political Opposition and Attempts to Repeal the ACA

The ACA has been the subject of political debate and legal challenges since its inception. Efforts to repeal or undermine the law, including the Trump administration’s attempts to eliminate the individual mandate, have created uncertainty in the healthcare market.

The Future of Health Insurance in the U.S.

11. Moving Toward Universal Coverage?

As healthcare costs continue to rise, there is growing momentum for expanding access to healthcare through a single-payer system, often referred to as “Medicare for All.” While this remains a contentious issue, the debate surrounding universal healthcare is likely to continue shaping the future of health insurance in the U.S.

12. The Role of Technology and Innovation

The future of health insurance may also involve increased use of technology, such as telemedicine and digital health platforms, to improve access to care and reduce costs. Innovative solutions may help bridge the gap between employer-sponsored insurance and ACA plans, providing more affordable and accessible options for all Americans.

Conclusion

The evolution of health insurance in the United States reflects the nation’s complex approach to healthcare. From employer-sponsored insurance to the introduction of the ACA, the system has evolved to address the changing needs of the population. While there are still challenges to overcome, the ACA has significantly improved access to care for millions of Americans. The future of U.S. health insurance will depend on continued innovation, policy reforms, and efforts to ensure that all Americans have access to affordable healthcare.

FAQs

1. What is employer-sponsored health insurance?

Employer-sponsored health insurance is a benefit provided by employers to their employees, offering coverage for medical expenses. It became widespread during and after World War II as a way for companies to attract workers.

2. How did the ACA change the health insurance landscape?

The ACA introduced key provisions like health insurance marketplaces, Medicaid expansion, and protections for individuals with pre-existing conditions. It significantly reduced the number of uninsured Americans.

3. Why do some people still lack health insurance under the ACA?

Some individuals still lack coverage because not all states expanded Medicaid, and some people may struggle with the cost of premiums or are ineligible for subsidies.

4. How does the ACA impact employer-sponsored insurance?

The ACA requires large employers to provide affordable insurance to their employees. It also created options for small businesses to offer coverage through the SHOP program.

5. Will the U.S. ever move to a single-payer healthcare system?

While the idea of a single-payer system, like Medicare for All, has gained attention, it remains politically contentious. The future of U.S. healthcare will depend on ongoing debates and policy decisions.